You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

SYLLABUS

GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment and Science and Technology- developments and their applications and effects in everyday life.

Context: Recently, India Post Payments Bank has launched its Aadhaar-based face authentication facility for customer transactions, which is expected to make digital banking more secure and convenient.

Aadhaar-based Face Authentication facility

• This Facility enables customers to perform banking transactions using facial recognition, eliminating the need for physical biometric inputs like fingerprints or OTPs.

• The face authentication feature was developed under the framework of UIDAI (Unique Identification Authority of India).

Key Benefits of IPPB’s Face Authentication Feature

• Inclusive Banking for the elderly, differently-abled, and individuals with worn fingerprints.

• Secure Aadhaar Authentication without dependency on OTP or fingerprint sensors.

• Fast & Contactless Transactions for a smoother customer experience.

• Safe Banking During Health Emergencies, where physical contact may be risky.

• Support for All Banking Services, including account opening, balance inquiry, fund transfers, and utility payments.

India Post Payments Bank (IPPB)

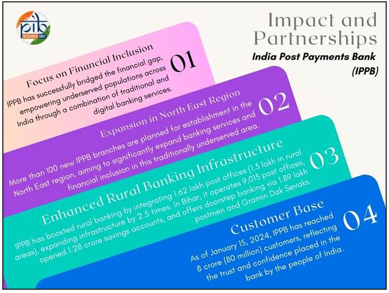

• IPPB was established in 2018 under the Department of Posts, Ministry of Communications, with 100% equity owned by the Government of India.

• IPPB aims to provide accessible, affordable, and reliable banking services to all Indians, with a special focus on rural and underserved areas.

• It leverages the extensive postal network to bring banking services to the doorstep of every citizen, supporting the government's financial inclusion objectives.

• IPPB are registered as a public limited company under the Companies Act of 2013 and is licensed under Section 22 of the Banking Regulation Act of 1949.

Legislations Governing IPPB

Key Features of IPPB

• Extensive Network: IPPB capitalises on India Post's vast network of over 155,000 post offices, with 135,000 located in rural areas.

• Doorstep Banking: Over 300,000 postmen and Gramin Dak Sewaks provide banking services at customers' doorsteps using smartphones and biometric devices, especially beneficial for those in remote areas.

• Digital Focus: IPPB offers a seamless, paperless, cashless, and presence-less banking experience through digital platforms, integrating core banking systems with smartphones and biometric devices.

• Accessibility: Banking services are available in 13 regional languages, ensuring inclusivity for India’s diverse population.

• Low-Cost Model: IPPB focuses on frugal innovation to keep its services affordable, especially for economically weaker sections of society.

Innovation and Partnerships

• Fincluvation Initiative: A platform launched to collaborate with fintech startups, co-create solutions, and innovate for financial inclusion.

• WhatsApp Banking Services: Launched in March 2023 in collaboration with Airtel, enabling customers to access banking services via WhatsApp with plans for multi-language support.

• Ria Money Transfer Partnership: Provides international inward money transfer services, initially available at over 25,000 Post Office locations.

Source

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2151308

https://cleartax.in/glossary/payment-banks

https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=152040&ModuleId=3

https://smefutures.com/india-post-payment-bank-begins-face-authentication-aadhaar-uid/

NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details