You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

SYLLABUS

GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

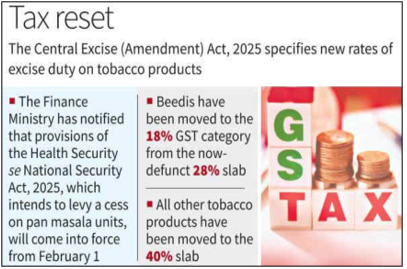

Context: The Union Ministry of Finance notified a new taxation framework for tobacco and pan masala products to take effect from February 1, 2026, replacing the GST compensation cess regime.

More on the News

• The Ministry of Finance issued multiple notifications on January 1, 2026 to operationalise the new taxation regime for tobacco products.

• The Central Excise (Amendment) Act, 2025 will come into force from February 1, 2026, introducing revised excise duty rates on tobacco products.

• Provisions of the Health and National Security Cess Act, 2025 relating to pan masala manufacturing will also take effect from the same date.

• February 1, 2026 has been notified as the date from which the GST compensation cess will cease to exist.

• With the repayment of GST compensation loans nearing completion, the cess has been fully withdrawn from all goods, including tobacco products.

Key Features of the New Tobacco Tax Regime:

• Post-cess fiscal restructuring: The GST compensation cess is replaced with a combination of higher GST rates, additional excise duty, and a new health and national security cess.

• A Health and National Security Cess will be levied on pan masala, while tobacco products will attract additional excise duty over and above GST.

• Strengthening deterrence through specific taxation: The excise duty structure has been revised to maintain a high overall tax incidence after the withdrawal of the compensation cess.

• Handmade bidis have been given concessional treatment with a duty of ₹1 per thousand sticks to protect the livelihoods of workers.

• Valuation and Production-Based Taxation:

Compliance and Monitoring Measures

• Manufacturers are required to install functional CCTV systems covering all packing and production areas.

• CCTV footage must be preserved for a period of 48 months to enable audit and enforcement.

• All manufacturers must file a detailed declaration of production capacity and machine specifications in Form CE DEC-01 by February 7, 2026.

• Machine speed and technical specifications must be certified by a Chartered Engineer through Form CE CCE-01.

• Export of notified tobacco products will be permitted only after payment of applicable duties.

Rationale Behind the Policy Shift

• Correcting Regressive tax outcomes: Lower specific excise duties under GST made cigarettes relatively more affordable, particularly for low-priced segments, diluting public health objectives.

• Alignment with WHO–FCTC recommendations: The new regime aligns with global public health guidance that recommends periodic increases in specific excise duties.

• National priorities: The Health and National Security Cess has been justified as a dedicated and non-lapsable funding source for national security needs.

• Administrative simplification for enforcement agencies: CCTV mandates and machine-linked taxation improve monitoring efficiency and reduce litigation over valuation disputes.

NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details