You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

SYLLABUS

GS2: Important International institutions, agencies and fora- their structure, mandate.

Issues Relating to Development and Management of Social Sector/Services relating to Health, Education, Human Resources.

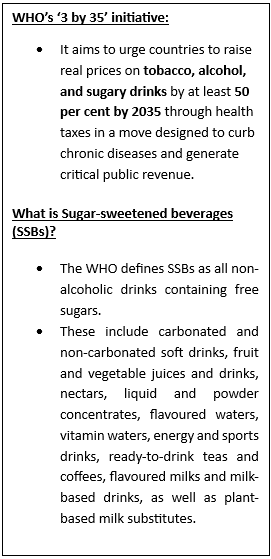

Context: The WHO’s 2025 Global Report on Sugar-Sweetened Beverage Taxes finds that although over half of countries tax sugar-sweetened beverages (SSBs), the average tax is just 6.8% of the retail price.

More on the News:

• Releasing two papers, the WHO has called on countries to raise and redesign taxes as part of its new 3 by 35 initiatives to reduce consumption and improve health outcomes.

• The WHO report notes that at least 167 countries tax alcoholic beverages and 12 ban alcohol altogether, yet alcohol has become more affordable.

• The assessment is based on WHO data compiled for the second time since the report was first published in 2023.

Key Findings of the Report

• Leading sources of sugars: Sugary drinks including sodas, ready-to-drink teas/coffees, sweetened milks, energy drinks and fruit juices.

• Tax Coverage Gaps: The reports show that at least 116 countries tax sugary drinks, many of which are sodas.

• Energy Drink Taxes at a Standstill: Although 97% of countries tax energy drinks, this proportion has stayed the same since the 2023 global report.

• Poor Alcohol Taxation: Tax shares on alcohol remain low with global excise share medians of 14% for beer and 22.5% for spirits, indicating limited fiscal pressure on alcohol consumption.

• Regional Inequities: As per study by nonprofit Center for Science, Multinational and local producers of sugar-sweetened beverages are investing heavily in low- and middle-income countries in the wake of declining sales in wealthy countries.

• Inadequate Health Allocation of Tax Revenue: Of the 116 countries that apply excise taxes on non-alcoholic beverages, only 10 countries dedicate the revenue specifically to health programmes.

• Regional Consumption Pattern: The highest consumption rates were observed in Colombia, in contrast, countries like India, China and Bangladesh recorded the lowest consumption.

Health Impact of Sugary drinks and Alcohol:

• Low Nutritional Value: Sugary drinks are quickly digested, causing blood sugar spikes and providing little or no nutritional value.

• Rise in Noncommunicable Diseases: Diets high in sugary beverages, often combined with foods rich in salt and saturated fats, are a major driver of obesity and diet-related noncommunicable diseases, including type 2 diabetes and heart disease.

• Impact on children and adolescents: Rising obesity rates among Indian children, fuelled by aggressive marketing of sugary beverages, are contributing to early-onset diabetes and metabolic disorders.

• Aggravating Cancer Risk: Alcohol consumption is a well-established risk factor for multiple cancers, including oral, oesophageal, liver, colorectal and breast cancers.

Recommendations of the report:

• Raise and Redesign Health taxes: WHO Director-General noted that Increasing taxes on products like tobacco, sugary drinks and alcohol, can help governments reduce harmful consumption and unlock funds for vital health services.

• Promote Healthy Alternatives: The consumption of healthy substitutes such as water should be incentivised and not taxed.

• Inflation Adjusted taxation System: Sugary drink taxes should be regularly updated to reflect inflation, ensuring prices remain high enough to discourage consumption over time.

India’s Taxation regime for Sugary Drinks

• GST “Sin Tax” Framework: At the 56th GST Council meeting held in September 2025, cold drinks, flavored sodas, iced tea, and energy drinks were officially classified as “sin” goods alongside tobacco and alcohol, attracting a 40% GST.

• Eat Right India (ERI) Initiative: Launched by the Food Safety and Standards Authority of India (FSSAI) to improve dietary habits, reduce intake of harmful food components (like excess sugar), and promote safe, healthy and sustainable food choices.

• National Health Policy (2017): Provides the policy backing and justification for higher taxes on sugary drinks, alcohol and tobacco.

• FSSAI Labelling Regulations: Mandatory nutrition labels (sugar content disclosure) and warning labels to aware consumers.

NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details