You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

SYLLABUS

GS-2: Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

GS-3: Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment.

Context: Recently, over 145 countries agreed to amend the 2021 OECD Global Minimum Tax deal to retain the 15 per cent rate while accommodating U.S. concerns.

More on the News

• The agreement was finalised under the aegis of the OECD (Organisation for Economic Co-operation and Development), which stated that the update enhanced tax certainty, reduced complexity and protected tax bases.

• The revised package retained the 15 per cent global minimum corporate tax framework.

• The update introduced simplifications and carve-outs to align U.S. minimum tax rules with global standards.

• The changes addressed objections raised earlier by the Trump administration, which argued the deal penalised U.S. multinationals.

• The revised pact stabilised the global tax framework after U.S. threats of withdrawal and retaliatory taxation.

• The agreement followed a June 2025 deal among G7 countries that exempted some U.S. firms from parts of the original framework.

• As of October 2025, more than 65 countries had already begun implementing the 2021 global tax deal.

Global Minimum Corporate Tax Agreement

• The global minimum corporate tax agreement was adopted in 2021 under the OECD Inclusive Framework.

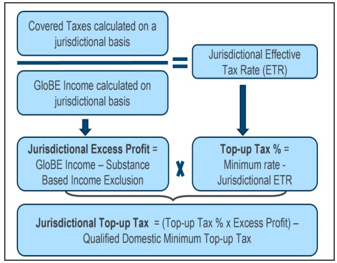

• The agreement led by the OECD aimed to ensure large multinational corporations (with over €750m revenue) pay a minimum 15% tax rate on profits in the country they operate.

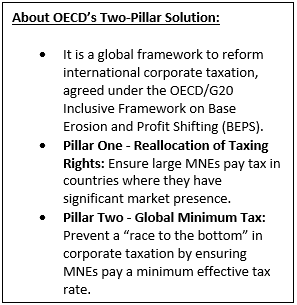

• It sought to curb profit shifting to low-tax jurisdictions and prevent a race to the bottom in corporate taxation.

• The agreement allowed countries to impose a top-up tax if profits were taxed below the minimum rate elsewhere.

• It improved fairness in the international tax system by aligning taxation with real economic activity.

• It is part of Pillar Two of the OECD’s broader two-pillar solution for International tax reform.

About the OECD:

• It is an intergovernmental body established in 1961 that works to promote economic growth, financial stability, trade and improved living standards among member countries.

• Its headquarters are located in Paris, France.

• OECD has 38 member countries. The members include nations from Europe, the Americas, Asia, and Oceania that are committed to democracy and market economies.

• India is not a member of OECD.

News in Short

Global Minimum Corporate Tax Deal

The Fifth edition of “Trade Watch Quarterly”

Farming Expansion Threatens Global Biodiversity Hotspots

Draft Pesticides Management Bill, 2025

Trump's 'Donroe Doctrine' seeks influence over Western Hemisphere citing old US policy

Global Minimum Corporate Tax Deal

The Fifth edition of “Trade Watch Quarterly”

Environment Panel Clears Kalai-II Hydropower Project Amid Concerns Over The White-Bellied Heron

NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details