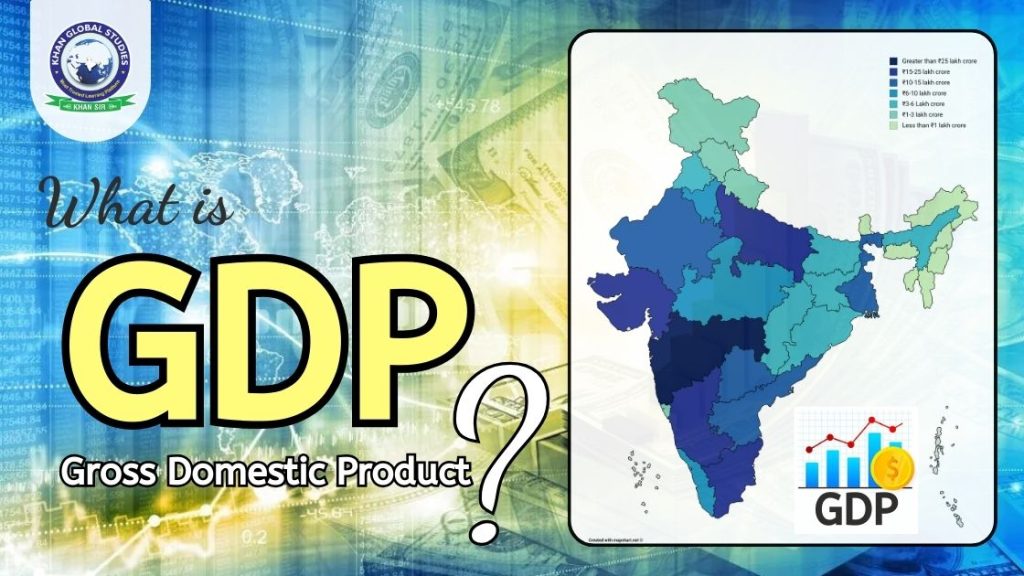

The growth of a country’s economy is measured in Gross Domestic Product (GDP). The increase in GDP shows that economic activities are increasing in the country and the standard of living of the people is improving.

It allows the government to decide how much it can tax and spend and helps businesses decide whether to expand and hire more people.

What is GDP?

The full name of GDP is Gross Domestic Product and it is the value of goods and services produced in any country in a financial year. If the GDP of a country is high and the standard of living of the people is quite good, then it is called a developed country. At the same time, if the GDP of a country is weak and the standard of living of the people is also below a limit, then it is called a developing country.

In India, the Central Statistics Office (CSO) estimates the GDP four times a year. That means GDP is estimated every quarter. It releases annual GDP growth figures every year.

How is GDP calculated?

GDP is measured through four important components.

- The first component is ‘consumption expenditure’. It refers to the total expenditure of people on purchasing goods and services.

- Second is ‘Government Expenditure’, third is ‘Investment Expenditure’ and finally comes net exports.

- GDP is measured in nominal and real terms. In nominal terms, it is the value of all goods and services at prevailing prices.

- When this is adjusted for inflation to the base year, we get real GDP. We generally think of real GDP as the growth of the economy.

GDP data is collected from eight regions. These include agriculture, manufacturing, electricity, gas supply, mining, quarrying, forestry and fishing, hotels, construction, trade and communications, financing, real estate and insurance, business services and community, social and public services.

Types of GDP

GDP can be reported in several ways, each of which provides slightly different information.

Nominal GDP

Nominal GDP is a measure of economic output in an economy that takes into account current prices. In other words, it does not slow down the pace of inflation or rising prices, which could push up the growth figure.

All goods and services counted in nominal GDP are valued at the prices at which those goods and services were sold in that year. To compare countries’ GDP in purely financial terms, nominal GDP is measured in local currency or US dollars at money market exchange rates.

Nominal GDP is used when comparing different quarters of production within the same year. Real GDP is used when comparing the GDP of two or more years. This is because, in effect, removing the effects of inflation allows comparisons across years to focus only on volume.

Real GDP

Real GDP is an inflation-adjusted measure that reflects the number of goods and services produced by an economy in a given year, with prices adjusted year-to-year to separate the effects of inflation or deflation from the trend in production over time. The year is adjusted. Because GDP is based on the monetary value of goods and services, it is subject to inflation.

Rising prices increase a country’s GDP, but it does not necessarily reflect changes in the quantity or quality of goods and services produced. Thus, by looking at the nominal GDP of an economy, it can be difficult to tell whether the figure has increased due to actual expansion in production or simply due to rising prices.

Economists use a process that adjusts for inflation to arrive at the real GDP of an economy. By adjusting output in any given year to the price levels prevailing in a reference year, called the base year, economists can adjust for the effects of inflation. In this way, it is possible to compare a country’s GDP from one year to another and see if there has been any real growth.

Real GDP is calculated using the GDP price deflator, which is the difference in prices between the current year and a base year. For example, if prices rose 5% since the base year, the deflator would be 1.05. The nominal GDP is divided by this deflator to get the real GDP. Nominal GDP is typically higher than real GDP because inflation is typically a positive number.

Real GDP accounts for changes in market prices and thus reduces differences between production figures from year to year. If there is a large discrepancy between a country’s real GDP and nominal GDP, it may be an indicator of significant inflation or deflation in its economy.

GDP per Capita

GDP per capita is a measure of the gross domestic product per capita of a country’s population. It indicates that the amount of output or income per capita in an economy can indicate average productivity or average standard of living. Gross domestic product per capita can be stated in nominal, real (inflation-adjusted), or purchasing power parity (PPP) terms.

In the original interpretation, GDP per capita represents how much economic production value can be attributed to each citizen. It also translates as a measure of overall national wealth as the market value of per capita GDP also conveniently serves as a measure of prosperity.

Gross domestic product per capita is often analyzed alongside more traditional measures of GDP. Economists use this metric to obtain information about their own country’s domestic productivity and the productivity of other countries. GDP per capita takes into account both a country’s GDP and its population. Therefore, it may be important to understand how each factor contributes to the overall outcome and is affecting per capita GDP growth.

For example, if a country’s GDP per capita is increasing with stable population levels, it may be the result of technological advances that are producing more with the same population levels. Some countries may have high per capita GDP but small populations, which usually means they have built a self-sufficient economy based on the abundance of particular resources.

GDP Growth Rate

The GDP growth rate compares year-on-year (or quarterly) changes in a country’s economic output to measure how fast an economy is growing. This measure, usually expressed as a percentage rate, is popular among economic policymakers because GDP growth is considered closely linked to key policy goals such as inflation and unemployment rates.

If the GDP growth rate accelerates, it could be a sign that the economy is overheating and the central bank may attempt to raise interest rates. In contrast, central banks view a shrinking (or negative) GDP growth rate (i.e. a recession) as a signal that rates should be lowered and stimulus may be necessary.

Gross Domestic Product Purchasing Power Parity (PPP)

Although not a direct measure of GDP, economists look at PPP to see how a country’s GDP is measured in international dollars using a methodology that allows cross-country comparisons of real output, and real income and adjusts for differences in local prices and cost of living.

How does GDP affect the lives of common people?

GDP has a direct impact on the common man. If GDP increases, it has a positive impact on the people and more money comes into the hands of the government, due to which the government can spend more money on public welfare.

If the economy of a country grows rapidly then earning opportunities for people increase and they earn good money which improves their standard of living. Whereas if GDP falls then the income of the common man falls. Along with this, consumer demand also decreases and business income also declines. At the same time, due to average growth in GDP, jobs and new opportunities reduce and income also does not increase.

Why is this important to the general public?

It is important for the general public as it proves to be an important factor in decision-making for the government and the people.

- If GDP is increasing then it means that the country is performing well in terms of economic activities government policies are proving effective at the ground level and the country is going in the right direction.

- If GDP is slowing down or going into negative territory, it means the government needs to work on its policies to help get the economy back on track.

- Apart from the government, businessmen, stock market investors and various policymakers use GDP data to make the right decisions.

- When the economy performs well, businesses invest more money and expand production because they are optimistic about the future.

- But when GDP figures are weak then everyone starts saving their money. People spend less money and invest less. Due to this, economic growth becomes more sluggish.

- In such a situation, the government is expected to spend more money. The government gives more money to businesses and people through various schemes so that they in turn spend the money and thus promote economic growth.

- Similarly, policymakers use GDP data to make policies to help the economy. It is used as a yardstick for making plans.

Why do GDP figures keep changing again and again?

The UK produces the fastest estimates of GDP of major economies, approximately 40 days after the corresponding quarter. At that stage, only about 60% of the data is available, so the figure is revised as more information comes in. The ONS publishes more information about this on its website.

What impact does falling GDP have on the government?

- The tax income of the government declines.

- The debt burden on the government increases.

- The government spends less on infra.

- Due to low income, the government increases taxes.

GDP of India

At present, India’s GDP is growing at the rate of about 7% and it is the fastest-growing economy in the world. Big financial institutions of the world have also said that the Indian economy will perform well compared to Western countries and the possibility of recession here is also negligible.